1 Introduction to AI in Finance

Artificial intelligence has moved from peripheral experiment to central capability in finance, reshaping how institutions allocate capital, manage risk, and serve customers. As data volumes expand and regulation tightens, firms are shifting talent and investment toward AI-driven tools that augment analysis, automate decisions, and adapt in real time. The imperative is no longer whether to adopt AI but how to leverage it responsibly—balancing performance with explainability, fairness, and compliance in a high-stakes environment.

Across the industry, AI delivers impact along four practical pillars. In risk and compliance, dynamic models enhance credit underwriting and detect fraud and AML patterns with fewer false positives. In investments, AI synthesizes diverse, often unstructured signals to surface insights and potential alpha at scale. Customer experiences become personalized and embedded, enabling instant decisions and continuous risk checks behind seamless interfaces. Operationally, automation streamlines document processing, monitoring, and back-office workflows, freeing people to focus on higher-value tasks while improving speed, accuracy, and consistency.

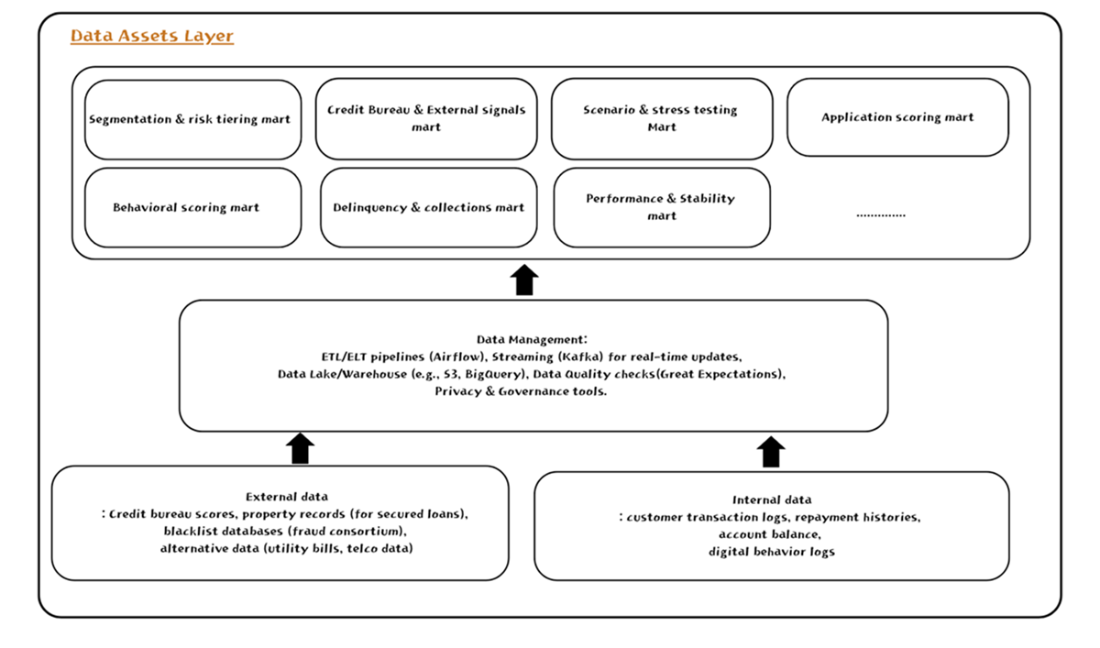

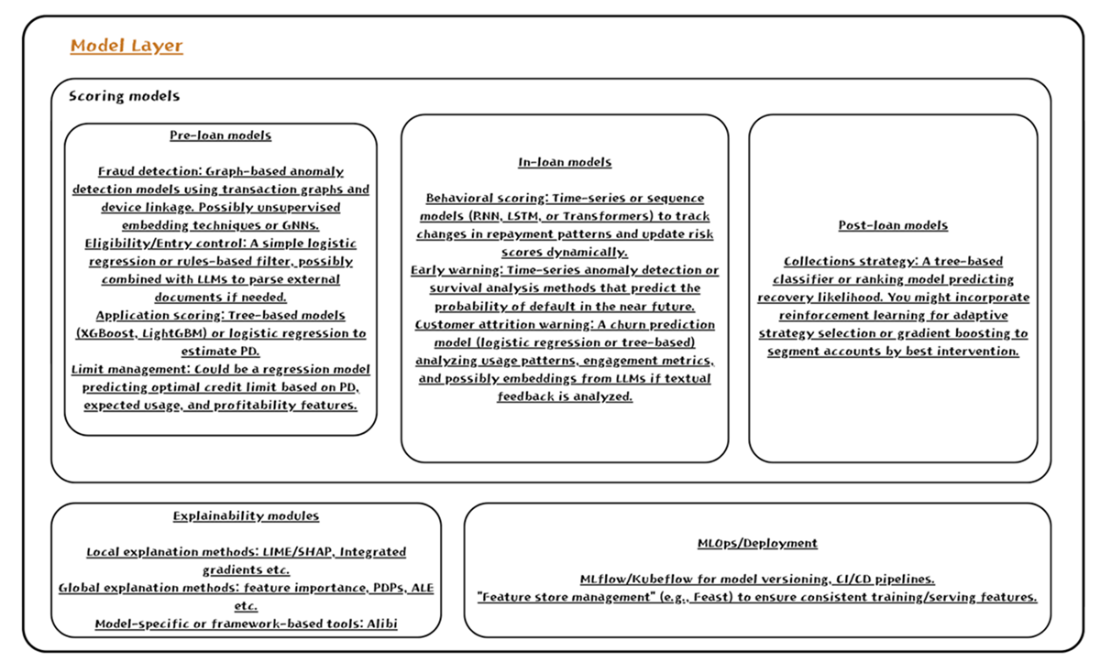

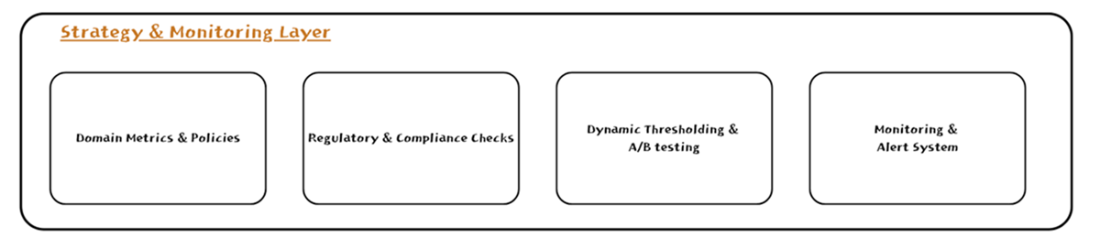

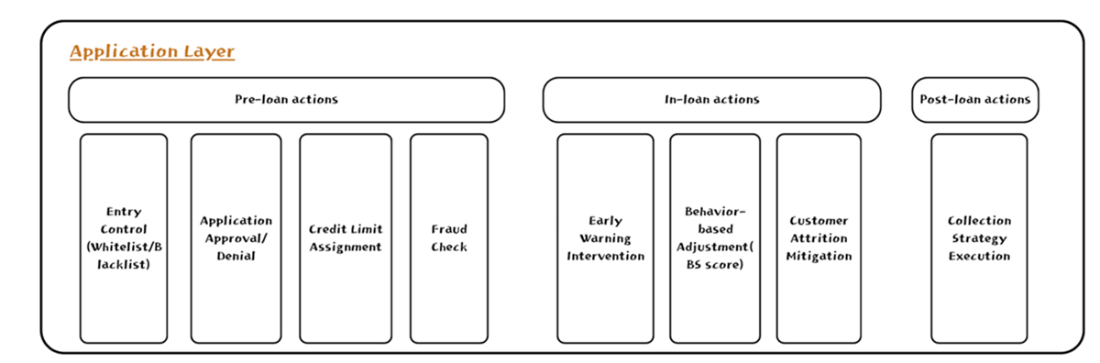

Turning promise into production relies on a four-layer architecture: a disciplined Data Asset Layer for secure, compliant, high-quality features; a Modeling Layer that spans classical ML to deep learning and LLMs with explainability and MLOps; a Strategy and Monitoring Layer that converts scores into policies, thresholds, and ongoing drift, bias, and performance checks; and an Application Layer that operationalizes insights in real-time decisions and feedback loops. A credit-scoring workflow illustrates this end-to-end design, from ingestion to approvals and lifecycle management. Practically, the chapter advocates accessible tools—Python, scikit-learn, Keras/TensorFlow, optional LLM APIs, plus Airflow and Evidently for orchestration and monitoring—so teams can build robust, adaptable systems and continuously align models with business outcomes and regulatory demands.

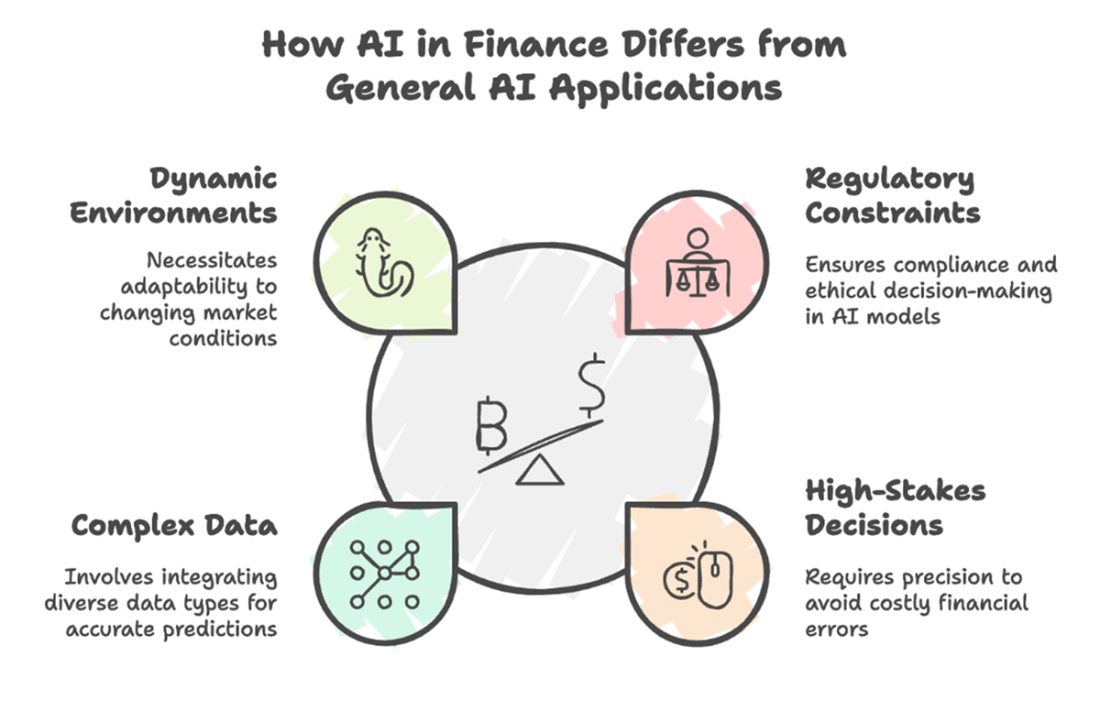

How AI in finance differs from general AI applications. Unlike many industries, finance requires continuous adaptation to changing markets, strict regulatory compliance ensuring fairness and explainability, uncompromising precision to handle high-stakes decisions, and the integration of diverse, complex data. These conditions shape every aspect of building and deploying effective AI-driven financial solutions.

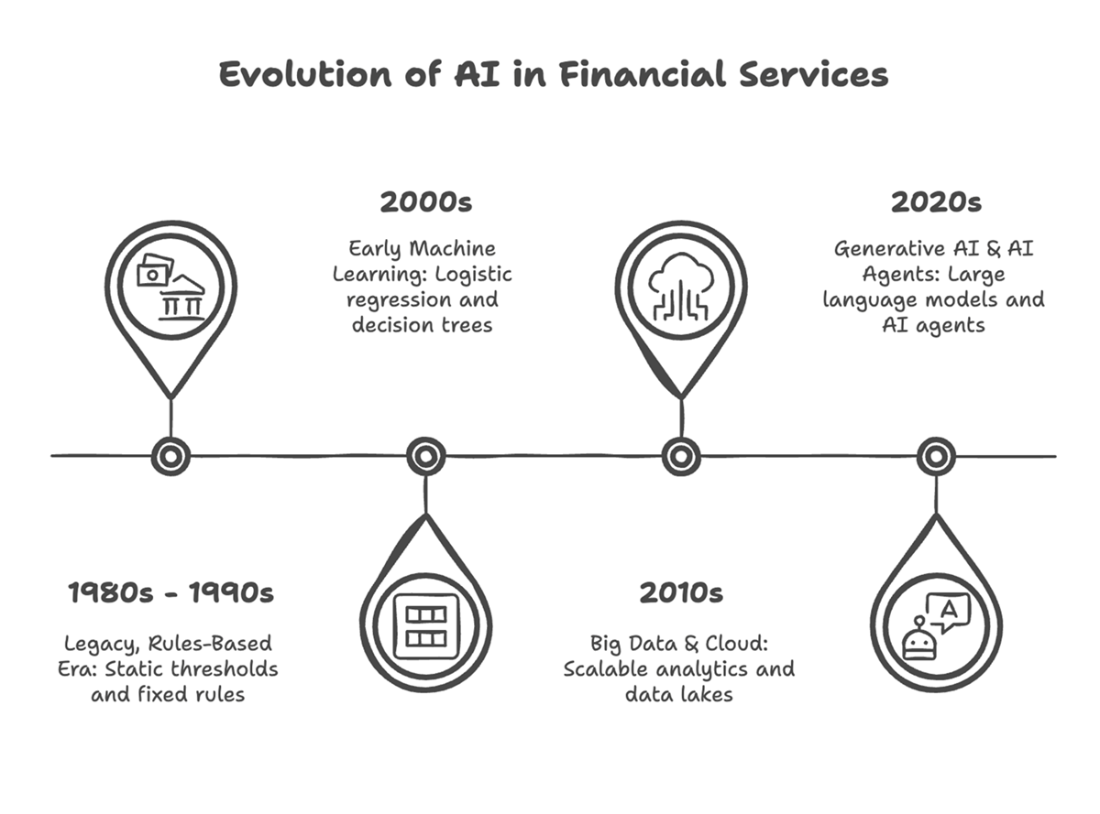

Evolution of AI in Financial Services. This timeline illustrates four major milestones in the industry's journey, from the static, rules-based systems of the 1980s and 1990s to today's generative AI and autonomous agents. Each phase—early machine learning, the rise of big data and the cloud, and the current wave of large language models—expanded AI's capabilities and its impact on the competitive landscape.

The Data Asset Layer. This figure illustrates how raw data—repayment histories, credit bureau snapshots, and alternative signals—flows into specialized data marts. Ensuring data lineage, access control, and regulatory compliance are critical steps before modeling. By creating consistent, domain-focused features, the Data Asset Layer provides a solid foundation for accurate credit decisions.

The Modeling Layer. Here, AI models turn curated features into default probabilities, fraud signals, or risk segments. Explainability tools (e.g., LIME or SHAP) offer transparency into each factor’s influence on the final score. Ongoing MLOps practices—such as scheduled retraining or hyperparameter optimization—help keep models current in shifting economic climates.

The Strategy & Monitoring Layer. Domain metrics, rate caps, and threshold policies shape how raw scores become lending actions. Ongoing monitoring detects data or concept drift, ensuring the model’s real-world performance remains stable. A/B testing and other experimentation approaches allow teams to refine credit strategies without risking large-scale exposure.

The Application Layer. Loan officers, collection agents, and end customers interact with AI-driven outcomes via dashboards or real-time notifications. By bridging front-end systems (like customer portals) and back-end rule engines, actions like approvals, limit changes, or fraud checks happen seamlessly. Because it’s closely tied to monitoring feedback loops, the Application Layer can adapt quickly to new data or policy shifts.

Summary

- AI in finance integrates data-driven modeling techniques into traditional workflows, enabling improved risk assessment, enhanced customer experiences, advanced trading strategies, and more streamlined operations.

- Understanding core building blocks—Data Asset, Modeling, Strategy & Monitoring, and Application Layers—helps break down complex AI systems into manageable parts.

- A concrete example in credit scoring shows how these layers interact: raw data transforms into predictive insights, which then guide policies and final lending decisions.

- Tools and technologies like Python, ML/DL frameworks, and optional orchestration and monitoring tools provide a flexible, accessible stack for building and maintaining financial AI solutions.

- This book teaches AI in finance through hands-on projects, real-world datasets, domain-specific metrics, and evolving model lifecycles—equipping you to adapt these methods beyond the examples given.

- By the end of Chapter 1, you know what to expect: practical guidance, multiple scenarios, ongoing refinement, and a focus on integrating AI into real financial operations for lasting, scalable impact.

Financial AI in Practice ebook for free

Financial AI in Practice ebook for free